Cash Flow Statement:

Cash flow signifies the movements of cash in and out of a business concern. A company generates cash and spends cash and as such cash flow analysis is very useful for a company. It is mainly needed for short-run planning.

A fund flow statement on cash basis is prepared by the following steps:

1.Classifying net balance sheet changes that seen between two points in time into changes that increase and decrease cash.

2.Classifying from the profit and loss (income statement) the factors that increase and decrease cash.

3.Consolidating this information into a source and use of funds format

The following are the sources of cash-

a. the profitable operations of the firm,

b. decrease in assets (expect cash),

c. increase in liabilities (including debentures or bonds), and

d. Sale proceeds from an ordinary or preference share issue.

The following are the uses of cash-

a. the loss from operations,

b. increase in assets (except cash),

c. decrease in liabilities (including redemption of debentures or bonds),

d. redemption of redeemable preference shares, and

e. cash dividends

The easiest and direct method of preparing a statement of changes in cash position is to only record inflows and outflows of cash, and find out the net change during a given period. If the net change in the cash position has to be found out from the income or profit and loss statement and comparative balance sheets, adjustments for the non-cash items are also to be made. Like cash from operations can be found out by adding depreciation to net profit as depreciation is a non-cash expense. Gain on sale of a non-current asset should be deducted while loss should be added to net profit.

Accounting is based upon accrual concepts that report revenues as earned and expenses as incurred, rather than when received and paid. Accrual information is perhaps the best indicator of business success or failure.

Accounting is based upon accrual concepts that report revenues as earned and expenses as incurred, rather than when received and paid. Accrual information is perhaps the best indicator of business success or failure.

However, one cannot ignore the importance of cash flows. For example, a rapidly growing successful business can be profitable and still experience cash flow difficulties in trying to keep up with the need for expanded facilities and inventory. On the other hand, a business may appear profitable, but may be experiencing delays in collecting receivables, and this can impose liquidity constraints. Or, a business may be paying dividends, but only because cash is produced from the disposal of core assets. Sophisticated analysis will often reveal such issues.

Rather than depending upon financial statement users to do their own detailed cash flow analysis, the accounting profession has seen fit to require another financial statement that clearly highlights the cash flows of a business entity. This required financial statement is appropriately named theStatement of Cash Flows. One objective of financial reporting is to provide information that is helpful in assessing the amounts, timing, and uncertainty of an organization’s cash inflows and outflows. As a result, the statement of cash flows provides three broad categories that reveal information about operating activities, investing activities, and financing activities. In addition, businesses are required to reveal significant noncash investing/financing transactions.

Investing Activities:

Cash flow signifies the movements of cash in and out of a business concern. A company generates cash and spends cash and as such cash flow analysis is very useful for a company. It is mainly needed for short-run planning.

A cash flow helps to make projections of cash inflows and outflows for the near future to determine the availability of cash during a particular time period. A cash flow statement summarizes the changes in cash position between dates of two balance sheets. To understand how a company obtains cash and how it spends cash during a given period, one needs to look at the changes in each of the items of the balance sheet over that period. It indicates the sources and uses of cash. Moreover, this statement analyses changes in non-current assets as well as current assets (other than cash) to determine the flow of cash.

A fund flow statement on cash basis is prepared by the following steps:

1.Classifying net balance sheet changes that seen between two points in time into changes that increase and decrease cash.

2.Classifying from the profit and loss (income statement) the factors that increase and decrease cash.

3.Consolidating this information into a source and use of funds format

The following are the sources of cash-

a. the profitable operations of the firm,

b. decrease in assets (expect cash),

c. increase in liabilities (including debentures or bonds), and

d. Sale proceeds from an ordinary or preference share issue.

The following are the uses of cash-

a. the loss from operations,

b. increase in assets (except cash),

c. decrease in liabilities (including redemption of debentures or bonds),

d. redemption of redeemable preference shares, and

e. cash dividends

The easiest and direct method of preparing a statement of changes in cash position is to only record inflows and outflows of cash, and find out the net change during a given period. If the net change in the cash position has to be found out from the income or profit and loss statement and comparative balance sheets, adjustments for the non-cash items are also to be made. Like cash from operations can be found out by adding depreciation to net profit as depreciation is a non-cash expense. Gain on sale of a non-current asset should be deducted while loss should be added to net profit.

Cash Flow And The Statement Of Cash Flows

However, one cannot ignore the importance of cash flows. For example, a rapidly growing successful business can be profitable and still experience cash flow difficulties in trying to keep up with the need for expanded facilities and inventory. On the other hand, a business may appear profitable, but may be experiencing delays in collecting receivables, and this can impose liquidity constraints. Or, a business may be paying dividends, but only because cash is produced from the disposal of core assets. Sophisticated analysis will often reveal such issues.

Rather than depending upon financial statement users to do their own detailed cash flow analysis, the accounting profession has seen fit to require another financial statement that clearly highlights the cash flows of a business entity. This required financial statement is appropriately named theStatement of Cash Flows. One objective of financial reporting is to provide information that is helpful in assessing the amounts, timing, and uncertainty of an organization’s cash inflows and outflows. As a result, the statement of cash flows provides three broad categories that reveal information about operating activities, investing activities, and financing activities. In addition, businesses are required to reveal significant noncash investing/financing transactions.

cASh Flow from OPERATING, INVESTING, AND FINANCING ACTIVITIES:

OperatingActivities: Cash inflows from operating activities consist of receipts from customers for providing goods and services, and cash received from interest and dividend income (as well as the proceeds from the sale of “trading securities”). Cash outflows consist of payments for inventory, trading securities, employee salaries and wages, taxes, interest, and other normal business expenses. To generalize, cash from operating activities is generally linked to those transactions and events that enter into the determination of income. However, another way to view “operating” cash flows is to include anything that is not an “investing” or “financing” cash flow.Investing Activities:

Cash inflows from investing activities result from items such as the sale of longer-term stock and bond investments, disposal of long-term productive assets, and receipt of principal repayments on loans made to others. Cash outflows from investing activities include payments made to acquire plant assets or long-term investments in other firms, loans to others, and similar items.

FinancingActivities: Cash inflows from financing activities include proceeds from a company’s issuance of its own stock or bonds, borrowings under loans, and so forth. Cash outflows for financing activities include repayments of amounts borrowed, acquisitions of treasury stock, and dividend distributions.

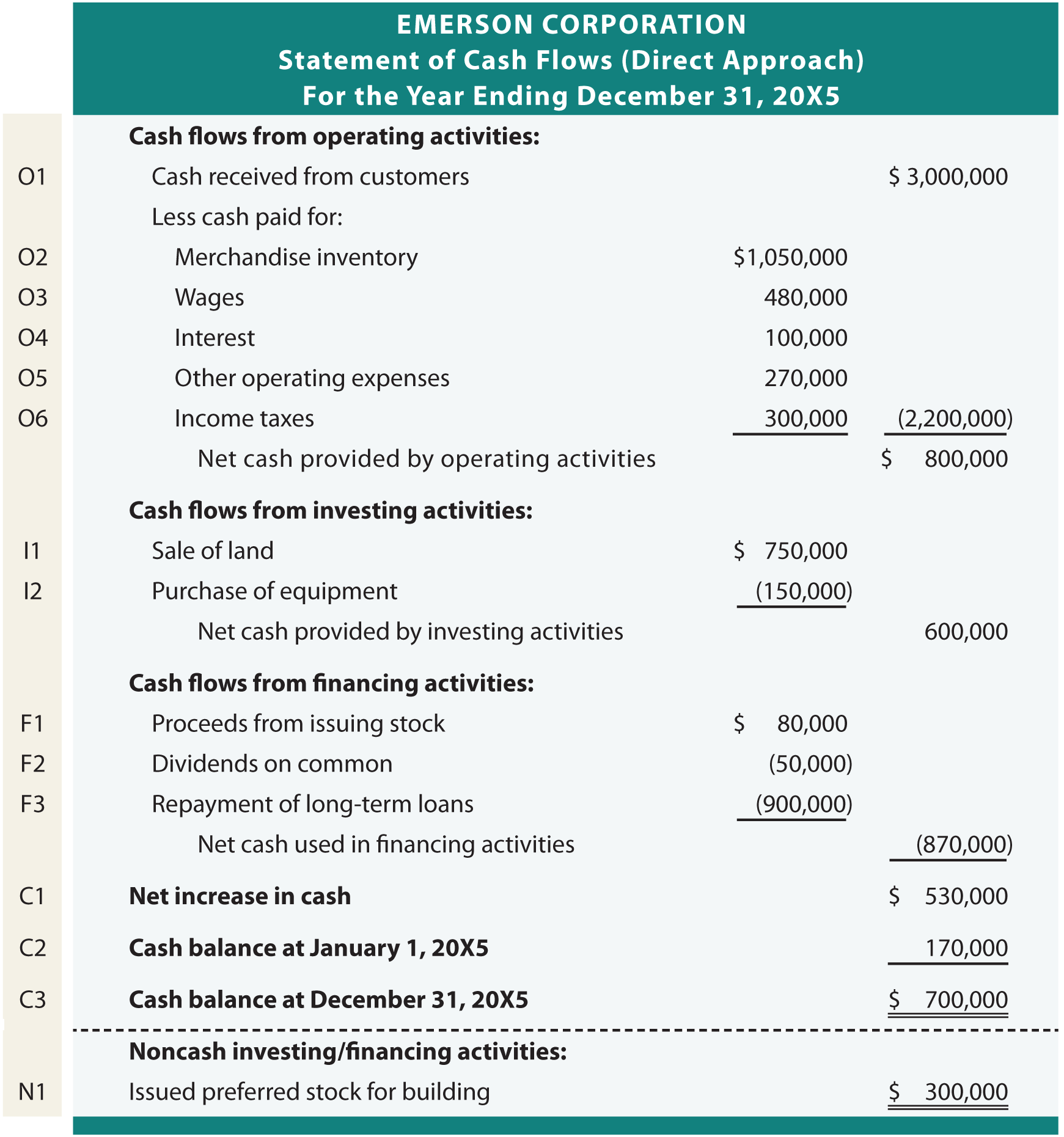

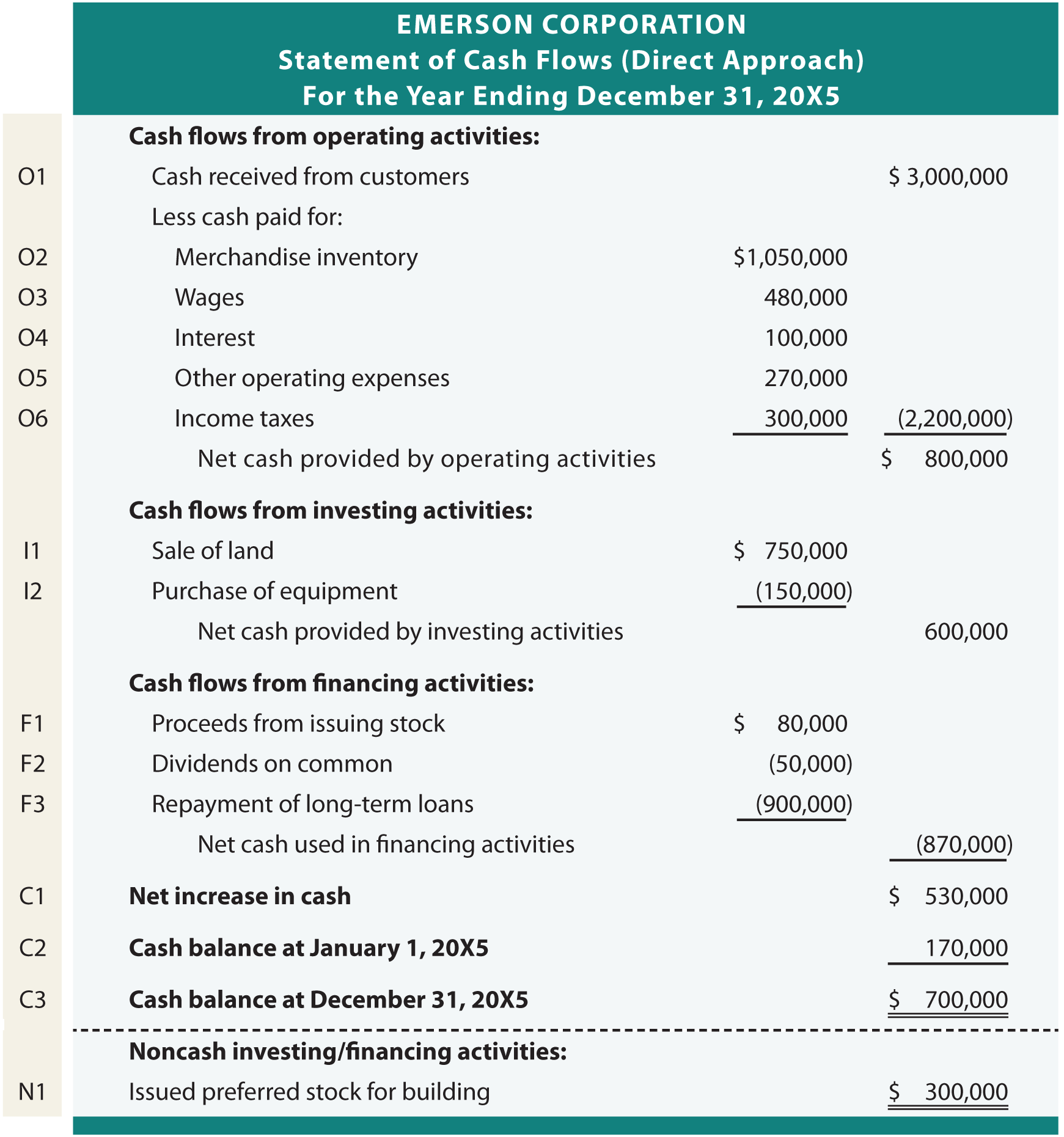

Spend just a few moments reviewing the preceding balance sheet, statement of retained earnings, and income statement for Emerson Corporation. Then, examine the following statement of cash flows. Everything within this cash flow statement is derived from the data and additional comments presented for Emerson. The tan bar on the left is not part of the statement; it is to facilitate the “line by line” explanation that follows.

Spend just a few moments reviewing the preceding balance sheet, statement of retained earnings, and income statement for Emerson Corporation. Then, examine the following statement of cash flows. Everything within this cash flow statement is derived from the data and additional comments presented for Emerson. The tan bar on the left is not part of the statement; it is to facilitate the “line by line” explanation that follows.

Notice that Line 01 appears as follows:

Emerson’s customers paid $3,000,000 in cash. Emerson’s information system could be sufficiently robust that a “database query” could produce this number. On the other hand, one can infer this amount by reference to sales and receivables data found on the income statement and balance sheet:

Emerson’s customers paid $3,000,000 in cash. Emerson’s information system could be sufficiently robust that a “database query” could produce this number. On the other hand, one can infer this amount by reference to sales and receivables data found on the income statement and balance sheet:

Accounts receivable increased by $250,000 during the year ($850,000 - $600,000). This means that of the total sales of $3,250,000, a net $250,000 went uncollected. Thus, cash received from customers was $3,000,000. If net receivables had decreased, cash collected would have exceeded sales.

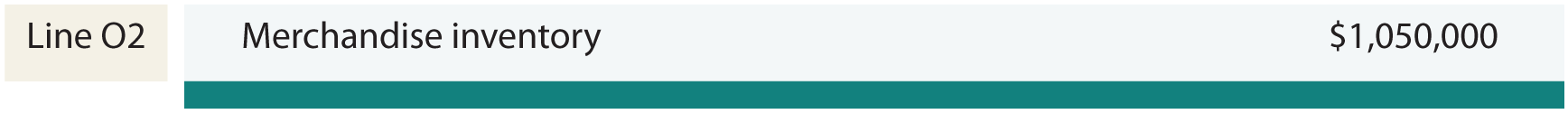

Emerson paid $1,050,000 of cash for inventory. Bear in mind that cost of goods sold is the dollar amount of inventory sold. But, the amount of inventory actually purchased will be less than this amount if inventory on the balance sheet decreased. This would mean that some of the cost of goods sold came from existing stock on hand rather than having all been purchased during the year. On the other hand, purchases would be greater than cost of goods sold if inventory increased.

Emerson paid $1,050,000 of cash for inventory. Bear in mind that cost of goods sold is the dollar amount of inventory sold. But, the amount of inventory actually purchased will be less than this amount if inventory on the balance sheet decreased. This would mean that some of the cost of goods sold came from existing stock on hand rather than having all been purchased during the year. On the other hand, purchases would be greater than cost of goods sold if inventory increased.

Emerson paid $480,000 of cash for wages during the year. Emerson’s payroll records would indicate the amount of cash paid for wages, but this number can also be determined by reference to wages expense in the income statement and wages payable on the balance sheet:

Emerson paid $480,000 of cash for wages during the year. Emerson’s payroll records would indicate the amount of cash paid for wages, but this number can also be determined by reference to wages expense in the income statement and wages payable on the balance sheet:

Emerson not only paid out enough cash to cover wages expense, but an additional $30,000 as reflected by the overall decrease in wages payable. If wages payable had increased, the cash paid would have been less than wages expense.

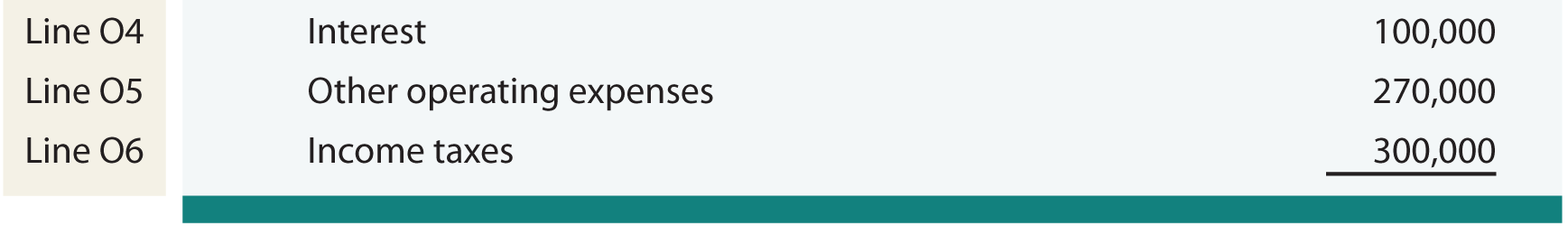

Emerson’s cash payments for these items equaled the amount of expense in the income statement. Had there been related balance sheet accounts (e.g., interest payable, taxes payable, etc.), then the expense amounts would need to be adjusted in a manner similar to that illustrated for wages.

Emerson’s cash payments for these items equaled the amount of expense in the income statement. Had there been related balance sheet accounts (e.g., interest payable, taxes payable, etc.), then the expense amounts would need to be adjusted in a manner similar to that illustrated for wages.

Overall, operations generated net positive cash flows of $800,000. Notice that two items within the income statement were not listed in the operating activities section of the cash flow statement:

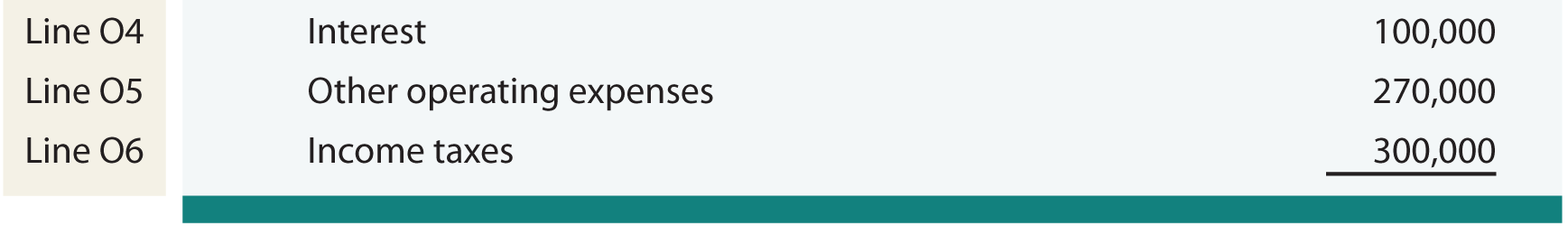

Notice that the statement of cash flows for Emerson reports the following line item:

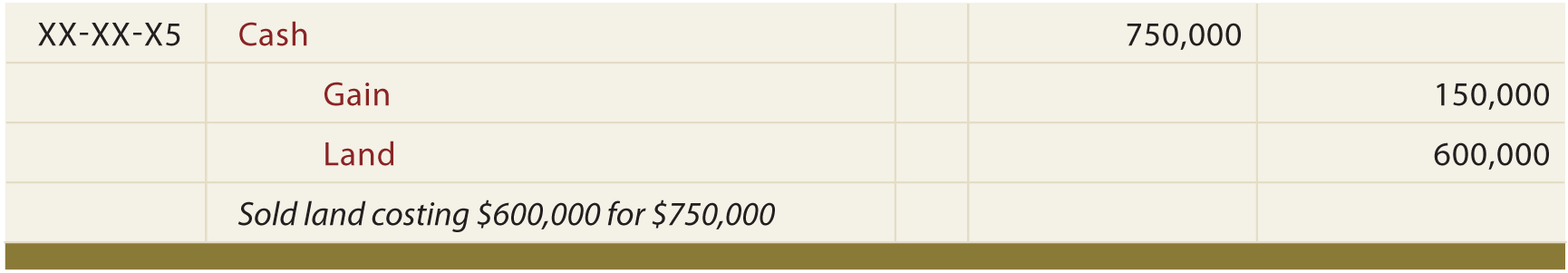

This line item reports that $750,000 of cash was received from the sale of land during the year. In actuality, it would be possible to look up this transaction in the company’s journal. That entry would appear as follows:

Emerson purchased equipment for $150,000 during the year. Notice that equipment on the balance sheet increased by $150,000 ($1,050,000 - $900,000). One could confirm that this was a cash purchase by reference to the journal; such is assumed in this case.

Emerson purchased equipment for $150,000 during the year. Notice that equipment on the balance sheet increased by $150,000 ($1,050,000 - $900,000). One could confirm that this was a cash purchase by reference to the journal; such is assumed in this case.

This line reveals that $80,000 was received from issuing common stock. This cash inflow is suggested by the $10,000 increase in common stock ($910,000 - $900,000) and $70,000 increase in additional paid-in capital ($370,000 - $300,000).

The statement of retained earnings reveals that Emerson declared $50,000 in dividends. Since there is no dividend payable on the balance sheet, one can assume that all of the dividends were paid.

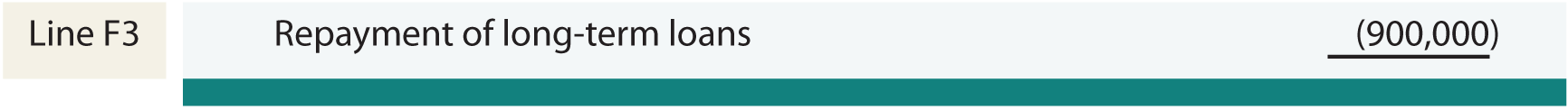

The balance sheet reveals a $900,000 decrease in long-term debt ($1,800,000 - $900,000). This represented a significant use of cash.

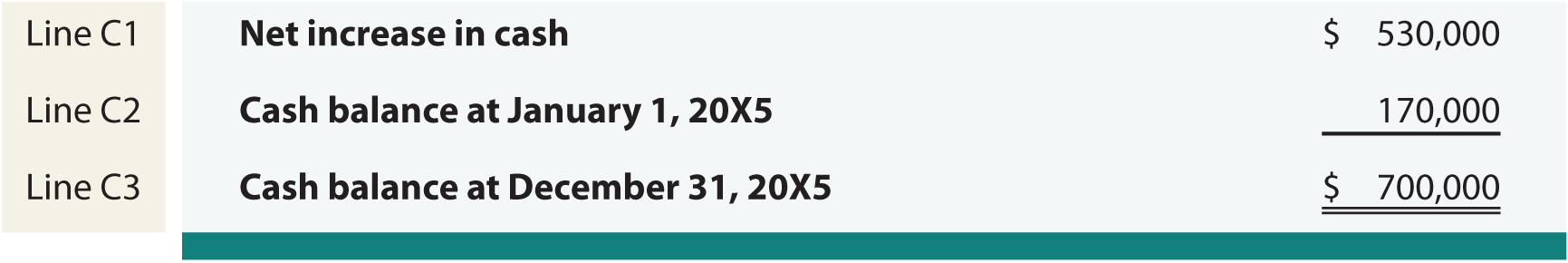

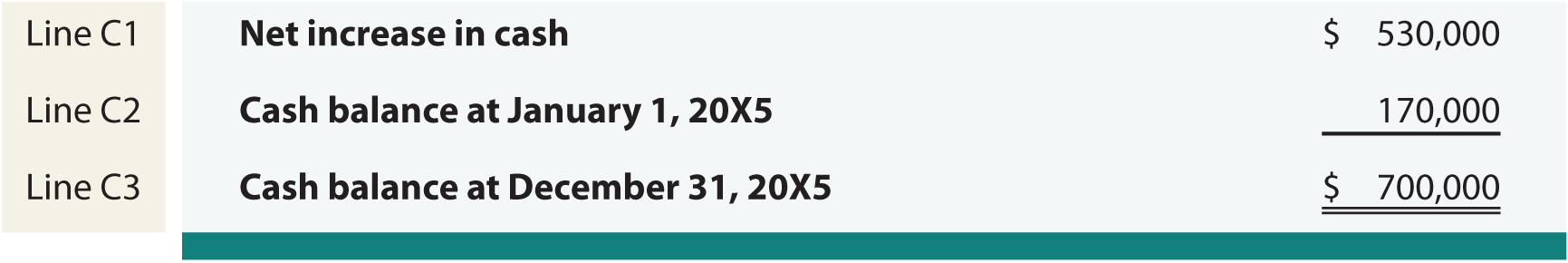

Emerson had a $530,000 increase in cash during the year ($800,000 from positive operating cash flow, $600,000 from positive investing cash flow, and $870,000 from negative financing cash flow). This change in cash is confirmed by reference to the beginning and ending cash balances.

NON CASH INVESTING/FINANCING ACTIVITIES

The noncash investing and financing section reports that preferred stock was issued for a building.

The noncash investing and financing section reports that preferred stock was issued for a building.

Sources: principlesofaccounting.com , kkhsou.in

FinancingActivities: Cash inflows from financing activities include proceeds from a company’s issuance of its own stock or bonds, borrowings under loans, and so forth. Cash outflows for financing activities include repayments of amounts borrowed, acquisitions of treasury stock, and dividend distributions.

There are potential distinctions between US GAAP and international accounting standards. IFRS permits interest received (paid) to be disclosed in the investing (financing) section of a cash flow statement. The global viewpoint also provides more flexibility in the classification of dividends received (and paid). Additionally, international standards encourage disclosures of cash flows that are necessary to maintain operating capacity, versus cash flows attributable to increasing capacity.

NONCASH INVESTING AND FINANCING ACTIVITIES

Some investing and financing activities occur without generating or consuming cash. For example, a company may exchange common stock for land or acquire a building in exchange for a note payable. While these transactions do not entail a direct inflow or outflow of cash, they do pertain to significant investing and/or financing events. Under US GAAP, the statement of cash flows includes a separate section reporting these noncash items. Thus, the statement of cash flows is actually enhanced to reveal the totality of investing and financing activities, whether or not cash is actually involved. The international approach is to present such information in the notes to the financial statements.

Cash Received From Customers

=

Total Sales Minus the Increase in Net Receivables (or, plus a decrease in net receivables)

=

$3,250,000 - ($850,000 - $600,000)

=

$3,000,000

Inventory Purchased

=

Cost of Goods Sold Minus the Decrease in Inventory (or, plus an increase in inventory)

=

$1,160,000 - ($220,000 - $180,000)

=

$1,120,000

Inventory purchased is only the starting point for determining cash paid for inventory. Inventory purchased must be adjusted for the portion that was purchased on credit. Notice that Emerson’s accounts payable increased by $70,000 ($270,000 - $200,000). This means that cash paid for inventory purchases was $70,000 less than total inventory purchased:

Cash Paid for Inventory

=

Inventory Purchased Minus the Increase in Accounts Payable (or, plus a decrease in accounts payable)

=

$1,120,000 - ($270,000 - $200,000)

=

$1,050,000

Cash Paid for Wages

=

Wages Expense Plus the Decrease in Wages Payable (or, minus an increase in wages payable)

=

$450,000 + ($50,000 - $20,000)

=

$480,000

Overall, operations generated net positive cash flows of $800,000. Notice that two items within the income statement were not listed in the operating activities section of the cash flow statement:

- Depreciation is not an operating cash flow item. It is a noncash expense. Remember that depreciation is recorded via a debit to Deprecation Expense and a credit to Accumulated Depreciation. No cash is impacted by this entry (the “investing” cash outflow occurred when the asset was purchased), and

- The gain on sale of land in the income statement does not appear in the operating cash flows section. While the land sale may have produced cash, the entire proceeds will be listed in the investing activities section; it is a “nonoperating” item.

INVESTING ACTIVITIES

The next major section of the cash flow statement is the cash flows from investing activities. This section can include both inflows and outflows related to investment-related transactions. Emerson Corporation had one example of each; a cash inflow from sale of land, and a cash outflow for the purchase of equipment. The sale of land requires some thoughtful analysis.Notice that the statement of cash flows for Emerson reports the following line item:

This line item reports that $750,000 of cash was received from the sale of land during the year. In actuality, it would be possible to look up this transaction in the company’s journal. That entry would appear as follows:

But, it is not necessary to refer to the journal. Notice that land on the balance sheet decreased by $600,000 ($1,400,000 - $800,000), and that the income statement included a $150,000 gain. Applying a little “forensic” accounting allows one to deduce that $600,000 in land was sold for $750,000, to produce the $150,000 gain.

FINANCING ACTIVITIES

This line reveals that $80,000 was received from issuing common stock. This cash inflow is suggested by the $10,000 increase in common stock ($910,000 - $900,000) and $70,000 increase in additional paid-in capital ($370,000 - $300,000).

The statement of retained earnings reveals that Emerson declared $50,000 in dividends. Since there is no dividend payable on the balance sheet, one can assume that all of the dividends were paid.

The balance sheet reveals a $900,000 decrease in long-term debt ($1,800,000 - $900,000). This represented a significant use of cash.

CASH FLOW RECAP

Emerson had a $530,000 increase in cash during the year ($800,000 from positive operating cash flow, $600,000 from positive investing cash flow, and $870,000 from negative financing cash flow). This change in cash is confirmed by reference to the beginning and ending cash balances.

NON CASH INVESTING/FINANCING ACTIVITIES

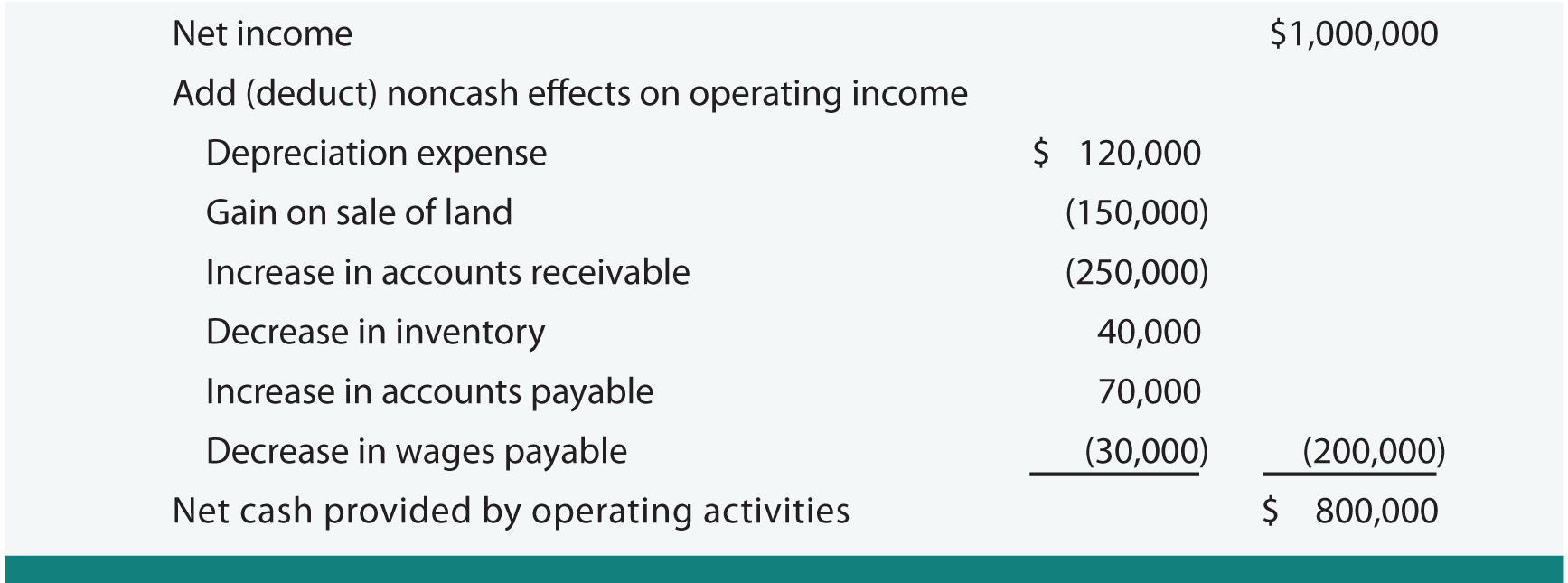

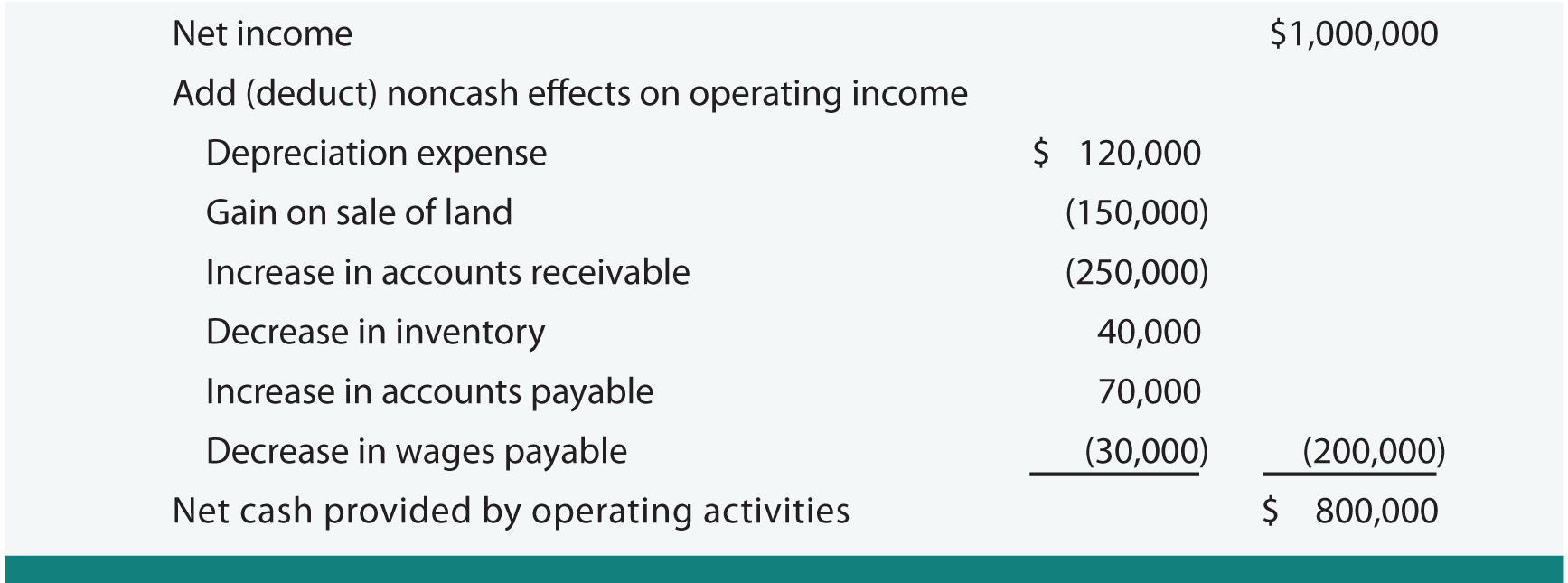

RECONCILIATION The statement of cash flows just presented is known as the “direct approach.” It is so named because the cash items entering into the determination of operating cash flow are specifically identified. In many respects, this presentation of operating cash flows resembles a cash basis income statement. An acceptable alternative is the “indirect” approach. Before moving on to the indirect approach, be aware that companies using the direct approach must supplement the cash flow statement with a reconciliation of income to cash from operations. This reconciliation may be found in notes accompanying the financial statements:

Notice that this reconciliation starts with the net income, and adjusts to the $800,000 net cash from operations. Some explanation may prove helpful:

Notice that this reconciliation starts with the net income, and adjusts to the $800,000 net cash from operations. Some explanation may prove helpful:

- Depreciation is added back to net income, because it reduced income but did not consume any cash.

- Gain on sale of land is subtracted, because it increased income, but is not related to operations (remember, it is an investing item and the “gain” is not the sales price).

- Increase in accounts receivable is subtracted, because it represents uncollected sales included in income.

- Decrease in inventory is added, because it represents cost of sales from existing inventory (not a new cash purchase).

- Increase in accounts payable is added, because it represents expenses not paid.

- Decrease in wages payable is subtracted, because it represents a cash payment for something expensed in an earlier period.

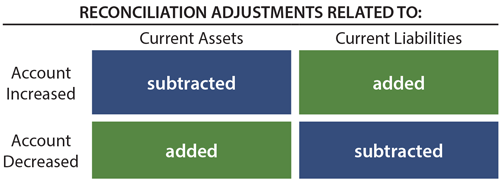

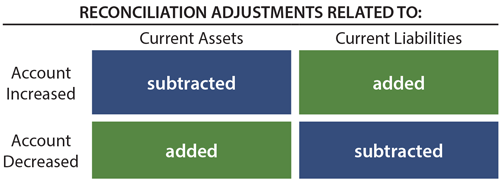

The following drawing is useful in simplifying consideration of how changes in current assets and current liabilities result in reconciliations of net income to operating cash flows. Begin by thinking about a reconciling item that is fairly easy to grasp. Emerson’s accounts receivable increased on the balance sheet, but the amount of the increase was subtracted in the reconciliation (again, this increase reflects sales not yet collected in cash, and thus the subtracting effect). In the drawing below, consider that accounts receivable is a current asset, and it increased. This condition relates to the upper left quadrant; hence the increase is shown as “subtracted.”

Using the accounts receivable analysis as a benchmark, it then becomes logical that all increasing current assets result in subtractions in the reconciliation. This relationship is inversed for current liabilities, as shown in the upper right quadrant of the drawing. Similarly, these relationships are further inversed for account decreases as shown in the bottom half of the drawing. With the drawing it mind, it becomes a simple matter to examine changes in specific current accounts to determine whether they are generally added or subtracted in the reconciliation of net income to cash flows from operating activities.

Although accounting standards encourage the direct approach, most companies actually present an indirect statement of cash flows. The indirect approach is so named because the “reconciliation” replaces the direct presentation of the operating cash flows. Except for the shaded areas, this statement is identical to the direct approach. The first shaded area reflects the substitution of the operating cash flow calculations. The second shaded area reflects that the indirect approach must be supplemented with information about cash paid for interest and taxes.

Although accounting standards encourage the direct approach, most companies actually present an indirect statement of cash flows. The indirect approach is so named because the “reconciliation” replaces the direct presentation of the operating cash flows. Except for the shaded areas, this statement is identical to the direct approach. The first shaded area reflects the substitution of the operating cash flow calculations. The second shaded area reflects that the indirect approach must be supplemented with information about cash paid for interest and taxes.

Sources: principlesofaccounting.com , kkhsou.in

I wish your site will be great in the work for your great sharing,,,

ReplyDeletemba statement of purpose